A Comprehensive Review of AutonomoInfo: An Essential Tool for Working Autonomo Visa Holders in Spain

If you’re considering moving to Spain on a working autonomo visa, one of the most crucial decisions you’ll make is choosing the right location to live. Taxes can vary significantly between regions, impacting your financial health and overall quality of life. This is where AutonomoInfo steps in as an indispensable resource.

Overview of AutonomoInfo

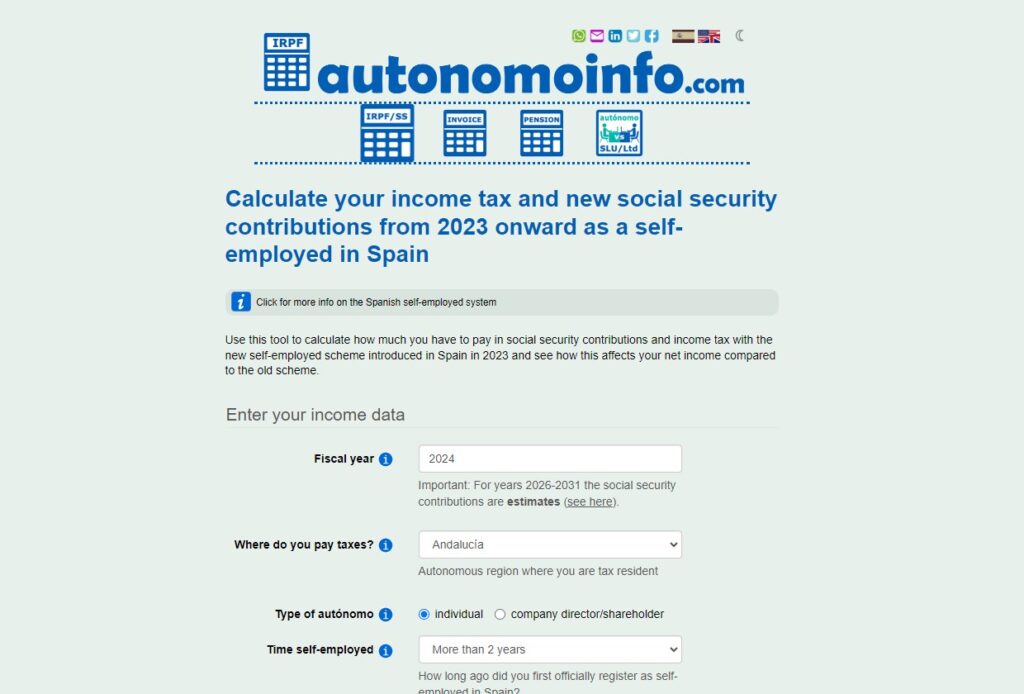

AutonomoInfo is a comprehensive platform designed specifically for self-employed professionals in Spain. It provides detailed information about tax obligations, social security contributions, and other financial considerations that autonomos must keep in mind. The website’s user-friendly interface makes it easy to navigate, allowing users to quickly find relevant information tailored to their specific needs.

Key Features of AutonomoInfo

- Tax Calculator: One of the standout features of AutonomoInfo is its tax calculator. This tool allows users to estimate their potential tax liabilities based on their projected income and the region they plan to live in. By inputting key financial details, you can get a clearer picture of what to expect, helping you make informed decisions.

- Regional Tax Comparisons: The site offers a breakdown of tax rates across different autonomous communities in Spain. This feature is invaluable for autonomos, as it enables them to compare the tax implications of living in different areas. For instance, regions like Madrid and Barcelona may have different tax structures compared to smaller municipalities.

- Guides and Articles: AutonomoInfo is rich in informative content, including guides and articles that cover various aspects of working autonomo in Spain. These resources provide insights into local regulations, social security contributions, and even tips on how to reduce tax burdens.

- Community Forum: Engaging with other autonomos through the platform’s forum can provide additional support. You can ask questions, share experiences, and gain insights from fellow self-employed professionals who have navigated the complexities of taxes in Spain.

Why AutonomoInfo is Essential for Autonomo Visa Holders

- Financial Planning: Moving to a new country is a significant investment, and understanding tax liabilities is essential for sound financial planning. By using the tools available on AutonomoInfo, you can project your income after taxes, helping you budget for housing, living expenses, and savings.

- Choosing the Right Location: Since tax rates can significantly impact your disposable income, selecting a region with favorable tax conditions is crucial. AutonomoInfo’s comparative tools allow you to analyze various regions, ensuring you make the best choice based on your financial situation.

- Navigating Bureaucracy: Spain’s tax system can be daunting, especially for newcomers. AutonomoInfo demystifies this process by offering straightforward guides on how to comply with tax regulations and obligations. This can help reduce stress and avoid potential pitfalls that could arise from misunderstanding local laws.

- Networking Opportunities: The platform’s community aspect fosters a sense of belonging. Engaging with other autonomos can lead to networking opportunities, collaborations, and support that are invaluable as you settle into your new life in Spain.

- Up-to-Date Information: Tax laws can change frequently. AutonomoInfo aims to keep its users updated with the latest information regarding tax rates, legal obligations, and best practices. This commitment ensures you remain informed about any changes that may affect your financial situation.

Conclusion

For individuals coming to Spain on a working autonomo visa, AutonomoInfo is more than just a resource; it’s a crucial ally in navigating the complexities of self-employment in a foreign country. With its suite of tools and resources, you can make informed decisions that will significantly impact your financial well-being and overall quality of life.

Whether you’re calculating your potential tax burden, exploring regional differences, or seeking advice from fellow autonomos, AutonomoInfo is an essential tool for ensuring a successful transition to life in Spain. Don’t underestimate the importance of understanding the tax implications of your new home—leverage AutonomoInfo to set yourself up for success in your new journey as a self-employed professional.